A Nonprofit’s Wealth Screening Guide

Longing to change up your fundraising strategy and find new donors to support your mission? Changes within your organization and the world of fundraising at large may have you wondering how new wealth screening tactics can enhance your strategy.

Let’s go through some of the ways iWave can assist you in finding donors through all phases of your fundraising journey. With accurate wealth screenings leading the way, you can make the right ask at the right time to bolster your fundraising efforts and reach or surpass your goals year after year.

What Is Wealth Screening?

At the heart of many of the most successful fundraising campaigns, you’ll find comprehensive wealth screenings. Traditionally, wealth screenings have been used to help your organization determine which prospective donors have the ability to donate to your cause.

Now used hand-in-hand with prospect research, wealth screenings scan wealth, philanthropic, and biographic records to provide a holistic view of your prospects and donors.

Wealth screenings enable development departments to segment hundreds or thousands of individuals you know very little about into a prioritized list of prospects with the greatest capacity and inclination to donate a gift to your organization. This data is then used to estimate the gift amount your team can ask for, ensuring no money is left on the table!

How Wealth Screening Can Assist Your Nonprofit Organization

Now that you understand what a wealth screening is, you may be wondering how this can be used to empower your nonprofit. The insights provided by wealth screenings can help you identify major donors with both the capacity and the affinity to contribute to your cause. The right wealth screening will also uncover annual fund prospects, planned giving prospects, and more.

By segmenting your donors according to your various fundraising strategies, you can streamline your organization’s fundraising efforts and donor solicitation process. From narrowing in on key prospective donors to helping you determine exactly how much to ask for, wealth screenings provide a clear path forward for your nonprofit’s fundraising team.

There are many different ways wealth screenings can assist you, some of which include:

-

Find major donors

Of course, major donors are always vital to your fundraising goals. With wealth screenings, you’ll be able to uncover who could potentially become a major donor by making large annual gift donations to your organization.

To put this into perspective, research shows that compared to other donors, major donors who contribute between $5,000 and $10,000 to a nonprofit organization are five times more likely to make a future donation. Taking advantage of accurate wealth screenings will better ensure the livelihood of your organization for years to come.

A major donor may also be part of a legacy gift program (in other words, a planned giver). About 78% of legacy gift givers contribute 15 or more donations throughout their lives to the same nonprofit they give a planned gift to.

iWave will help you identify those with the wealth capacity and inclination to give. We’ll even provide insights such as who your Hidden Gems are or who might be a more viable option later on. By having both a short- and long-range vision for your asks and major donor cultivation, you can better ensure you have the necessary funds to fulfill your mission.

-

Determine matching gift eligibility

Matching gifts are often an under-utilized resource, but can double the gift amounts you are receiving. The premise is simple: Certain companies pledge to match their employees’ donations—usually up to a fixed amount.

Use prospect research to determine which supporters work for companies offering this program, and then run a wealth screening to determine the gift ask. Matching gifts also allow you to reach out to those with a lower wealth capacity to give with a big return for your organization. This may encourage more donor prospects to make a contribution, since their gift will make an even greater impact.

Expanding your reach in this way can significantly increase how much you receive from your more extensive lower-tier donor base.

-

Efficiently gain a deep understanding of who donors are

In the past, gathering a comprehensive understanding of your donor base took a tremendous amount of time. Now, you can put together an accurate and wide-ranging portrait quickly. This saves you precious time you can dedicate elsewhere in your organization!

-

Providing analytics to guide next steps

What good is data if you’re not sure how to use it? iWave’s fundraising intelligence is all about actionable data, so you know what to do with the information you learn from your wealth screenings. In particular, iWave provides Cultivation and Engagement Analytics, so you understand which channels and messaging to use as you cultivate prospects.

-

Create solid fundraising goals

Once you’ve performed wealth screenings and have identified potential major donors, you will then be able to build an accurate and attainable fundraising goal. Use this research to build out your fundraising plan for the year and work your expenses around this number. This will help you stay on track and ensure your nonprofit remains organized.

-

Tailor asks based on affinity

Wealth screenings can also help you plan more personal asks. They give you a sneak peek at the donor and what their interests may be, helping you tailor your gift ask to the specific prospect.

All donors prefer to feel like individuals instead of mere demographics. A tailored ask fosters this sense of individuality.

If a donor has a keen interest or passion for a particular branch or program within your organization, you can focus your ask on the ways their donation can keep that program up and running for years to come.

-

Increase donations made by annual donors

If someone donates to your cause consistently, they may be a good candidate to up their gift size—even by a small amount. Since wealth screenings reveal capacity, you can see who can give more. For instance, maybe a donor is currently giving $25 but could be giving $250. The information you glean from wealth screenings can help nurture these donors!

This is just the tip of the iceberg for wealth screenings. Whether you want to support your annual fund or host a successful gala, wealth screenings can help secure the results you’re looking for.

Why you should care about Wealth Screening?

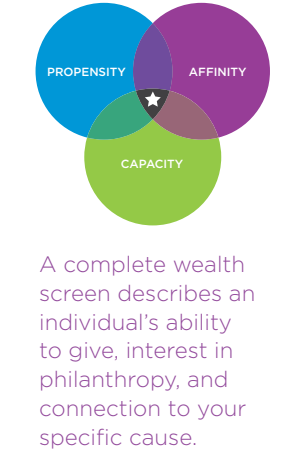

Every time a nonprofit prospect researcher or fundraiser considers a prospective donor, there are three big questions to answer:

- PROPENSITY: Does the person have a history of philanthropy?

- AFFINITY: Does the person have a connection to my cause?

- CAPACITY: Does the person have enough wealth to contribute a major gift?

If the answer to all three questions is yes, you have a great prospect. However, if you’re missing, or even ignoring, one or two of these prospect ratings, you’re missing the complete picture. Unfortunately, time often works against you. You could spend days or weeks determining just one prospect’s philanthropic fit. Automated processes like wealth screening help you segment and prioritize large groups of prospects simultaneously.

Wealth screening is a prospect identification process that highlights individuals with the greatest potential of contributing large donations to a particular nonprofit organization. Crafting the perfect wealth screen requires three major ingredients:

- A list of prospects provided by the nonprofit;

- Internal data about the nonprofit’s current donors, such as previous donation type and amount;

- External wealth, biographic, and philanthropic data provided by an electronic screening vendor.

A complete wealth screen requires the right data to determine the three keys. Screening isn’t just about finding high net worth indicators like high salary and real estate holdings. And just because a person may be wealthy, that doesn’t automatically mean they are philanthropic. A complete wealth screen will effectively show an individual’s ability to give, their interest in philanthropy, and if there is a connection to your specific cause.

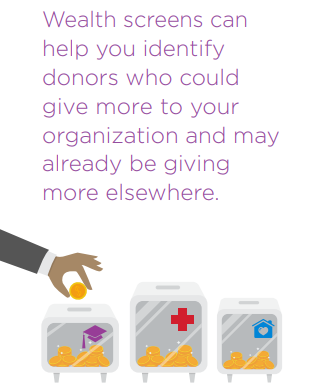

Wealth screening offers several benefits to your development team, such as helping you:

- determine if current donors can contribute larger gifts and if they are already doing so with other organizations;

- model major gifts, annual gifts, and planned gift donor profiles based on the wealth capacities and philanthropic histories of past and current donors;

- identify new gift prospects who fit your ideal donor profiles

- reconsider and revamp old fundraising approaches with new strategies based on cutting-edge internal and external giving data;

- complete all these tasks in a fraction of the time and cost it would take with manual, one-on-one prospect research or peer screening.

Wealth Screening Process: 7 Steps to perform wealth screening the right way

Step 1. Determine Your Goals

When beginning a wealth screen, the first step is to determine your goals. What do you want to gain from this screen? Maybe you only have interest in creating quick profiles for a handful of prospects, or maybe you are screening your entire database.

Consider these six questions:

- What do we need to know from the results?

- How do we define success?

- What group of prospects do we want to segment?

- Are we segmenting based on budget? How many returns can we reasonably get through? Is there a specific constituency type that we need to know more about? Or do we want to screen the whole group to get a baseline?

- Who will be responsible for dealing with the information when it comes back?

- Does the person have time for or need help doing the analysis, verification, rating, and coding needed?

Step 2. Sign Up for Training

As the old saying goes, “if all else fails, read the instruction manual.” Actually, we recommend registering for wealth screening training as a first step. Look to your screening vendor’s training and support resources. By reading how-to articles, watching tutorial videos, and chatting with client success professionals, you can avoid potential headaches.

For a start, you can check out our Wealth Screening Playbook which outlines the exact process you can replicate to leverage 100% of your wealth screens.

Even if screening is old-hat for you, there may be new upgrades to your screening tool. Check in often for updates and new features to better optimize your tool. If you are an iWave client, our Client Services team is ready to help you with one-on-one, personalized training. Be sure to watch our iWave Screening webinar to understand screening best practices.

Step 3. Clean Up and Segment Your Database

No matter which screening solution you choose or how advanced technology becomes, results will always include some errors. These errors are often simple things such as misspelled names or addresses, outdated data, and empty fields in your database. Remember, screening poor-quality data won’t produce actionable results.

Check our detailed webinar on how to carry out the perfect data hygiene to get better prospect matches and results.

To remedy poor-quality data, first consolidate duplicate records. Then, update old information when and wherever possible. Within your team, be sure to define a set of rules for regular data hygiene. For example: data older than two years should be updated or deleted.

Try to include contact information, internal giving records such as a gift date, gift amount, and gift frequency, as well as any existing relationship data.

If you don’t have the time or interest in screening your entire database, consider segmenting the database. Try screening these groups:

- Reunion classes

- Lapsed donors who recently resurfaced

- New patients at your hospital or non-alumni parents and grandparents who are affiliated with your education institution

- Season-ticket holders, purchasers of luxury box seats, or regular ticket buyers

- New-to-you donors giving above a particular threshold

- Donors in specific states or geographic regions

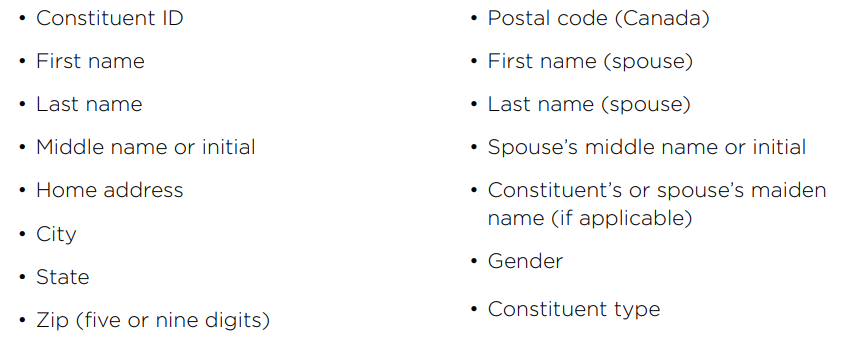

Step 4. Prepare the Template

Depending on the screening vendor your organization chooses, you will receive an input template or have the opportunity to download it yourself. With iWave Screening, the template is an Excel spreadsheet with a number of rows and columns. You have the option to use a standard template or custom template.

Alternatively, we recommend having a combination of the following information

Step 5. Customize Screening Parameters

One size doesn’t fit all with fundraising, major gift donors, or with wealth screening. It is important to customize screening parameters according to your organization’s strategy and goals.

DEFINE “MAJOR GIFT”

Not every gift is made equal. Remember, what one organization considers a “major gift” could be very different for another. In order to ensure you’re segmenting major gift prospects based on your specific fundraising strategy, customize your settings to reflect your expectations of a strong capacity rating.

SELECT YOUR PREFERRED AFFINITY

Not every wealthy donor will have a strong connection to your cause. Therefore to help find the best prospects, be sure to screen for the individual’s giving affinity. This will not only prioritize prospects based on capacity, but also how interested they are in your specific cause. If available, in your tool’s settings, select from a list of affinity categories such as Education, Healthcare, Arts and Culture, and many more.

ANALYZE INTERNAL GIVING

If your screening solution includes recency-frequency-monetary (RFM) scoring, you can use this feature to uncover major gifts that may be hiding in your database. There may be a longtime mid-level donor with the capacity to warrant a larger “ask.”

To ensure this is accounted for, input Total Gift Count, Total Gift Amount, and Last Gift Date in the screening template to unlock RFM insight. While you’re at it, make sure to customize RFM ratings just as you did with the capacity ratings.

ADJUST THE CONFIDENCE RATING

With some screening tools, a Confidence of Match (COM) setting controls the strictness of the filter that matches records to individuals. For example, each record involves a ‘score’ on a 1-10 scale which indicates iWave’s confidence that the record matches that particular individual. iWave has a pre-set, recommended confidence rating that will give you high-confidence records, but for more advanced users or unique scenarios, you can adjust this rating. The higher you set the COM, the stricter the matching algorithm. This means it will match against more input criteria and provide more accurate results with fewer falsepositives. It also means though that fewer records will be returned.

CUSTOMIZED THE PROPENSITY-AFFINITY-CAPACITY WEIGHTING

Depending on your project goals, you may consider identifying and segmenting prospects based on wealth indicators over anything else. Conversely, you may be only interested in philanthropic individuals regardless of their wealth. In iWave, a default prospect score gives a weighting of 33% to each of propensity, affinity, and capacity. However, the weighting can be easily adjusted if your organization has a specific focus.

Step 6. Do a Trial Run Containing the Wealth screening results

Consider running a small sample screen before submitting a larger list. A test list is beneficial because you can adjust your settings and template to find what works for your organization. When performing the test, Helen Brown and Jennifer Filla recommend submitting three groups within your overall test screen: 20 individuals you know well, 20 you know something about, and 20 that represent a cross section of each of your constituent types.

Step 7. Submit the File

When you have filled in all the information you need, it’s time to submit the file to the vendor. With some vendors, submitting is a manual process and it may take days or weeks before you get your results back. One benefit of iWave Screening is the ability to upload your completed template directly within iWave’s platform. We’ve designed a sophisticated record-matching process that returns results to you quickly, in some cases, even within hours or minutes.

Wealth Screening Data to Consider

When performing a wealth screening, there are two main indicators you should look at first: philanthropic indicators and wealth indicators. These indicators are then broken down into smaller, more specific data sets.

At iWave, we provide our clients with complete transparency into the data, formulas, and sources used for our wealth screenings. This enables you to validate the data and ratings yourself, which means you can trust the intel even further and make your data-driven fundraising asks with confidence.

Philanthropic Indicators

- Past Giving History: Has the prospect given to likeminded charities in the past? Do they donate often, such as every week, every month, or every year? If so, how much and when do/did they give?

- Nonprofit Involvement: Does the donor prospect volunteer frequently? Do they serve on a board? Do they regularly attend events? Have they participated in specific programs? If so, which ones and when were they involved?

- History with Your Organization: Have they worked with your team before? Have they contributed money, time, or resources in the past? If so, in what ways? Do they care about a specific initiative or aspect of your overall cause?

Wealth Indicators

- Real Estate Ownership: How many homes do they own? What is the value of the home(s)? A donor prospect who owns many properties may be more likely to give. Compared to the average donor, someone who owns $750,000 to $1 million in real estate is twice as likely to make a charitable contribution. Moving up, prospective donors who own $2 million or more in real estate are 17 times more likely to give.

- Stock Ownership: Do they own a lot of stocks? Do those stocks hold high value?

Not only does stock ownership indicate a donor prospect’s capacity to give, but it also means they have the potential to donate stock to your organization. Along with that, there could be an opportunity to pursue a corporate grant.

- Business Affiliations: Does their company offer matching gifts? Is the company prominent in their field? Are they an executive, major investor, or board member? If so, this could be an indicator that they have wealth to give.

The more factors a wealth screening scans for, the more complete of a picture you’ll receive, helping you save time and easily find the right supporters for your cause. Combining philanthropic and wealth information enables you to see clearly which donors have the capacity to give, a history of philanthropy, and an affinity for your cause. By letting this sweet spot be your guide, you set yourself up to meet your fundraising goals more efficiently.

The Best Wealth Screening Software

When performing individual look-ups or individual research, you have two main options: Do it all manually or use advanced fundraising solutions to streamline your work.

Having your team perform this research by hand is very time-consuming. They’ll have to spend a lot of time manually searching through billions of data points to gather the same type of information that a wealth screening can provide in minutes. However, if you choose a next-generation fundraising platform to assist, the process will be sped up considerably.

Your team works hard every day, and you want to make sure they have enough time and energy to perform critical work in your community on an ongoing basis. The time saved with a platform like iWave can help them do just that.

Build Highly Specific Prospect Profiles

One way to make your wealth screenings more effective is to build profiles. Comb through your current donor data to find commonalities between your supporters. If you find that many of your major donors own two or more homes, for example, this will be a key factor to scan for.

Segment these donors into more specific groups, as well, for the most accurate information possible. For example, annual donors may have different wealth indicators than event donors. By understanding what type of donor a prospect can be, you’ll have a more targeted gift ask to yield stronger results.

Every nonprofit organization is unique, so your supporters are bound to be unique as well. Discover what sets them apart to lead you to new supporters with a strong affinity for your cause.

Tap into the Full Power of Affinity with Our Industry-First Multi-Lens Modeling

Have you heard about our latest feature? It’s not just new to iWave—it’s new to the entire industry—and it provides you a chance to take advantage of donor affinity in ways you never have before.

As you perform wealth screenings, you can apply different lenses (hence Multi-Lens Modeling) to the same campaign. This allows you to segment viable donor prospects into categories that, while very different, all demonstrate a likelihood to support your cause.

Our Multi-Lens Modeling provides a holistic view of the donor that ensures fewer good prospects are overlooked during wealth screenings. It enables fundraising teams to uncover new giving opportunities and get more value out of every wealth screen.

Remember: Your Team Is Still the Beating Heart of Your Organization

Even with iWave’s help, it takes an incredible team of researchers and nonprofit team members to build the better world you desire. It’s their vision of the world and their passion for the cause that will make the biggest difference. iWave is here to help them along by providing them the support to utilize our customizable platform to the fullest.

Having the right tools will empower your team further and make fundraising a total success.

If you choose to make use of iWave’s customizable fundraising intelligence, you and your team will receive personalized onboarding and unlimited support. This will ensure every team member, both now and in the future, understands how to effectively use all that our next-generation platform has to offer.

How iWave Can Empower Your Nonprofit Organization’s Wealth Screening Process?

Using next-generation fundraising solutions is one of the easiest ways to streamline your wealth screenings and keep them current and highly effective.

At iWave, our next-generation platform quickly scans billions of data points to provide you with a clear and organized picture of how likely someone is to support your cause. This means your nonprofit will save time, energy, and resources, and even potentially find donors you had never considered before.

Our platform can also help uncover what we call “Hidden Gems.” These are prospective major donors who may be often overlooked, but have great potential. Additionally, our platform can be accessed via your mobile device, putting the power in your hands at all times.

The best way to see how iWave can help is to view us in action. Contact us today to schedule a free demo or fundraising assessment and get started on wealth screening software. Our team will also be here for you through every level of fundraising. We’ll grow alongside you and show you how our platform can adapt to all your needs. Finding major donors has never been easier—learn more today!

Stay Up-to-date on Fundraising News and Resources